Κατά τη διάρκεια της Ετήσιας Τακτικής Γενικής Συνέλευσης των Μετόχων, η οποία πραγματοποιήθηκε στις 9 Ιουλίου, ο Πρόεδρος & Διευθύνων Σύμβουλος κ. Γιάννης Λαπατάς ανακοίνωσε τα αποτελέσματα της χρήσης του 2024, που έκλεισε με Υψηλή Κερδοφορία, ενώ τα Ίδια Κεφάλαια της Ατλαντικής Ένωσης, αυξήθηκαν κατά 7,55% και ανήλθαν σε 93.881 εκατ. ευρώ, έναντι 87.289 εκατ. ευρώ το 2023, κατατάσσοντας την Εταιρεία στην πρώτη δεκάδα της Ελληνικής Ασφαλιστικής Αγοράς, με βάση τα ίδια κεφάλαιά της.

Η κάλυψη του περιθωρίου φερεγγυότητας στις 31/12/2024 στα πρότυπα της Solvency II Οδηγίας έφτασε σε 297% καλύπτοντας τρεις φορές περίπου τα απαιτούμενα εποπτικά κεφάλαια.

Οι Επενδύσεις της Εταιρείας στο ίδιο διάστημα ανήλθαν σε 170.754 εκατ. ευρώ, έναντι 161.954 εκατ. ευρώ το 2023, αυξήθηκαν κατά 5,43%.

Σε σύνολο Παραγωγής πέτυχε σημαντική άνοδο, με ποσοστό 14,81%, σε σχέση με το αντίστοιχο περσινό διάστημα.

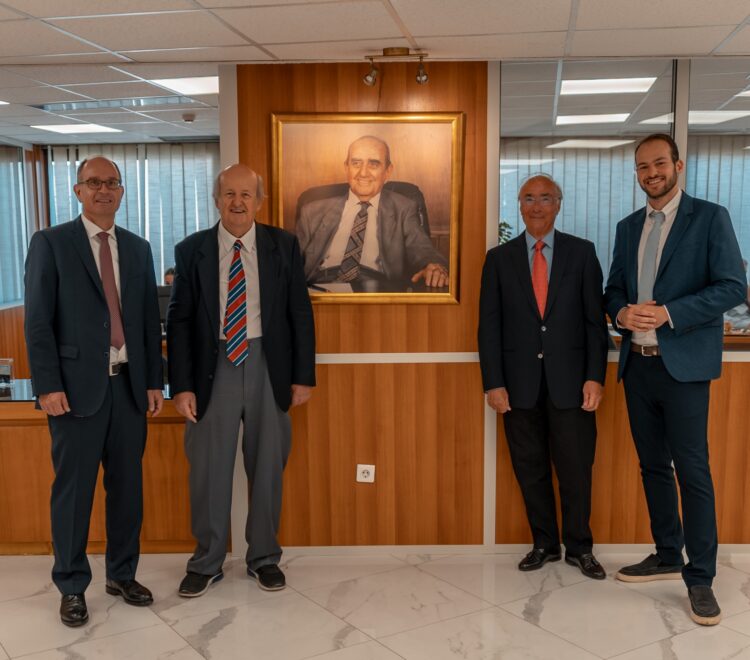

Τη Διοίκηση και τα Στελέχη της Εταιρείας συνεχάρη ο Εκπρόσωπος και Διευθύνων Σύμβουλος της Baloise Lebensversicherung AG κ. Juerg Schiltknecht, ο οποίος τόνισε:

«Θέλω να εκφράσω τα συγχαρητήριά μου στη Διοίκηση και το Προσωπικό της Εταιρείας, για τα πολύ καλά αποτελέσματα που είχε και το 2024 η Ατλαντική Ένωση.

Είμαστε απόλυτα ικανοποιημένοι από την ανάπτυξη και την κερδοφορία της Εταιρείας.

Προσβλέπουμε στη συνέχεια της καλής πορείας της Επιχείρησης και ελπίζουμε τα επόμενα χρόνια και ιδιαίτερα με τη συνένωση των δύο κορυφαίων Ομίλων της Ελβετίας Baloise – Helvetia, με συνολική παραγωγή περί τα 25 δισεκατομμύρια δολάρια, να έχουμε ακόμα στενότερη συνεργασία και σε άλλους τομείς».

Ως προς τη συγχώνευση της Baloise με την Helvetia ο κ. Juerg Schiltknecht ανέφερε:

- In which phase is the proposed merger between Baloise and Helvetia?

The proposed merger between Baloise and Helvetia was announced in April 2025, in May the extraordinary general meetings of both companies overwhelmingly approved the merger and we are in the process of obtaining all required regulatory and legal approvals.

- What is the estimated timeline for the legal and operation unification of both companies?

We expect the closing of the transaction to happen somewhere in Q4 of this year, but obviously it depends on obtaining all regulatory and legal approvals first. After closing, we have the ambition to unify both companies as fast as possible. Nevertheless, we expect the whole operational integration to last until 2028.

- How did the insurance market in Switzerland and abroad welcome the proposed merger between Baloise and Helvetia?

There’s a strong strategic rationale for this proposed merger that was also acknowledged by the market. This is also reflected by the high approval rates at the extraordinary general meetings which exceeded 95%.

- What would be the plans of the new Group for the European market and are there any plans outside Europe?

It is too early to have any joint plans for the combined Group, as we are still two separate, competing companies waiting for the proposed merger to be approved by the relevant authorities. As Baloise, we would like to host a capital markets day after closing, likely in Q1 of 2026, during which the combined Group would give an update on future plans.

- In how many countries would the new Group be present?

Subject to obtaining the approvals of the competent authorities, Baloise and Helvetia will be present in eight European markets. Currently, both companies have operations in Switzerland and Germany, otherwise they are complementary. In addition, Helvetia also operates outside of Europe in the areas of specialty lines and active reinsurance.

- What would be the total business volume after the merger between Baloise and Helvetia?

On a pro forma basis and subject to obtaining the necessary approvals, Helvetia and Baloise would have around CHF 20 bn business volume in 2024. The split between non life and life would be around 60% to 40%. In terms of market cap the combined Group would be one of the leading insurance companies in Europe and number two in terms of business volume in the joint home market Switzerland.

- Are you happy with Atlantic Union’s results for 2024 and for the 1st quarter 2025?

I am once more very happy with the performance of Atlantic Union. It has demonstrated its strength in 2024 and delivered again very convincing results and we see the path of success to continue in 2025. Not only this and last year, but over many years, Atlantic Union has sustainably delivered very good results. This is on the one hand the achievement of a well thought through strategic approach. On the other hand, a strategy alone is never good enough, it also needs to be implemented and executed. This is one of the top strengths of Atlantic Union, its leadership team that together with its longstanding employees really created in my view something special in the Greek insurance market.